Lake Norman Vacation Rental Investment Guide (Davidson Area 2025): ROI, Regulations & Reality

Updated October 23, 2025

Lake Norman vacation rental investments generate market-wide median annual revenues of $56,400-$66,022, though Davidson condo performance may vary below these averages. Negative cash flow typically occurs for median-performing properties due to mortgage costs, 8% occupancy taxes, and HOA restrictions. Top-performing luxury lakefront properties achieve $100,000+ annual revenue with proper management and strategic positioning.

Lake Norman Vacation Rental ROI: What 2025 Data Reveals

Market Performance Overview

Lake Norman's vacation rental market demonstrates solid performance metrics that vary significantly by property type, location, and management quality. Current 2025 data shows market-wide averages across the entire Lake Norman area, with Davidson properties potentially performing below these metrics depending on specific location and amenities.

Lake Norman Market-Wide Performance Metrics:

- Average Daily Rate (ADR): $444-$508

- Occupancy Rate: 42-43%

- Monthly Revenue: $4,696-$5,502 (median)

- Annual Revenue Potential: $56,300-$66,022

Note: Davidson condo performance may vary below these Lake Norman market-wide averages, particularly for non-waterfront or smaller units.

Top 10% Performer Statistics:

- Monthly Revenue: $13,155+

- Occupancy Rate: 81%+

- ADR: $967+

The seasonal variation significantly impacts returns across Lake Norman, with summer months generating $633 ADR and 62% occupancy rates market-wide, while winter months drop to $553 ADR with 37% occupancy. Davidson properties may experience different seasonal patterns depending on proximity to Davidson College events and downtown attractions.

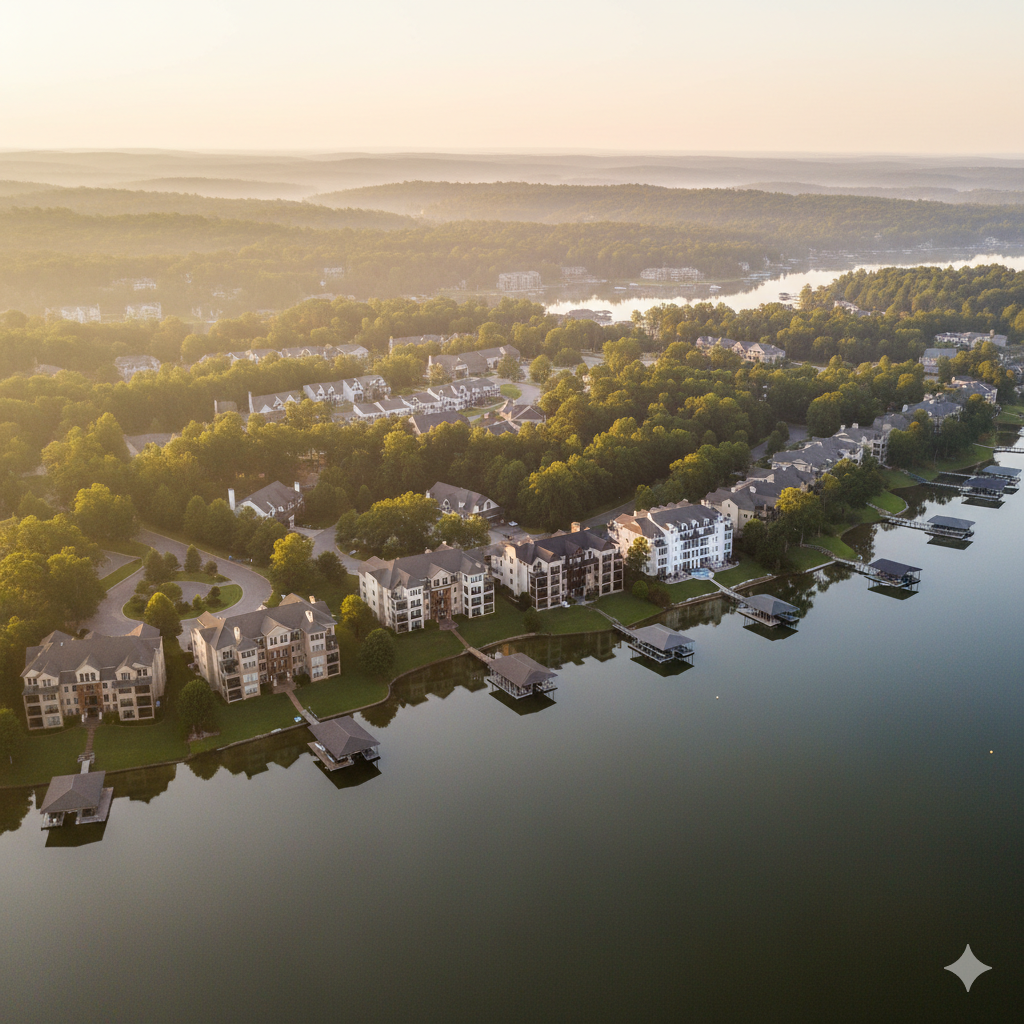

Davidson Landing Investment Analysis

Davidson Landing represents the premier vacation rental location on Lake Norman, offering 500+ waterfront condos and townhomes across 12 distinct complexes. The community provides resort-style amenities including boat slips, pools, waterfront boardwalks, and direct lake access.

Current Market Pricing (2025):

- 2-bedroom condos: $375,000-$630,000

- 3-bedroom units: $530,000-$990,000

- Median sale price: $533,000-$560,000

Strategic Location Advantages:

- 20-minute drive to Charlotte via I-77 Exit 30

- Walking distance to Davidson College events

- Access to downtown Davidson dining and entertainment

- Family-friendly established community reputation

For comprehensive insights on Lake Norman investment opportunities, review our detailed guide on buying investment property on Lake Norman.

Financial Reality Check: Davidson Landing Condo Investment

Conservative Scenario Analysis (Using Lake Norman Market Median Performance):

For a Davidson Landing 2-bedroom condo at $500,000:

Note: This analysis uses Lake Norman market-wide averages. Davidson condo performance may be lower, particularly for non-waterfront units or those with limited amenities.

Revenue Projections (Based on Lake Norman Market Medians):

- Monthly Revenue: $4,700 (annual: $56,400)

- Occupancy: 42%

- ADR: $450

Operating Expenses Breakdown:

- Mortgage (20% down, 7.5% rate): $33,600 annually

- Property taxes (Davidson/Mecklenburg ~0.76%): $3,800

- HOA fees: $1,932-$5,088 annually

- Property management (25-30%): $14,100-$16,920

- STR insurance: $2,000-$3,000

- Cleaning & maintenance (20% of revenue): $11,280

- Utilities & supplies: $3,000-$4,000

- Occupancy tax (8% Mecklenburg): $4,512

- Marketing & platform fees: $2,000

Total Annual Expenses: $76,224-$82,200

Net Cash Flow: -$19,824 to -$25,800 (negative cash flow)

Optimistic Scenario (Top 25% Performer):

- Annual Revenue: $101,316

- Net Cash Flow: $19,116-$25,116 (positive)

The financial analysis reveals median-performing Davidson Landing condos generate negative cash flow when accounting for all costs, particularly with current mortgage rates.

Davidson Vacation Rental Regulations: Critical Compliance Guide

North Carolina State Framework

North Carolina maintains a relatively favorable regulatory environment for short-term rentals compared to restrictive markets nationwide. Key state provisions include:

- No statewide STR ban exists

- No mandatory state registration required

- North Carolina Vacation Rental Act governs rentals under 90 days

- Courts have struck down overly restrictive local ordinances

2025 Legislative Update: Senate Bill 291, introduced in March 2025, aims to create uniform STR regulations but remains stalled in the legislature. The proposed bill would limit local governments' ability to ban STRs entirely.

Local Regulations: Davidson & Mecklenburg County

Critical Finding: The Town of Davidson does not maintain explicit short-term rental permits or licensing requirements based on current municipal documentation. However, investors face specific tax obligations and zoning considerations.

Tax Obligations:

- Mecklenburg County Occupancy Tax: 8% (highest in North Carolina)

- North Carolina Sales Tax: 6.75-7.5%

- Combined lodging tax burden: 14.75-15.5%

Tax collection typically occurs through platforms (Airbnb, Vrbo) for marketplace-listed properties.

For investors considering other Lake Norman communities, explore our comprehensive analysis of living in Davidson, NC to understand the broader market dynamics.

HOA Restrictions: Your Biggest Investment Risk

Davidson Landing consists of 12 separate condo complexes, each with independent HOA governance. HOA rental restrictions represent the most significant regulatory threat to STR investments.

North Carolina HOA Rental Restriction Framework:

- HOAs can ban or restrict STRs if provisions exist in CC&Rs

- Restrictions require membership approval, not just board votes

- Common restrictions include:

- Minimum lease terms (often 30+ days)

- Rental caps limiting percentage of units for rent

- Owner-occupancy requirements before renting

- Complete STR bans

2024 Legal Development: North Carolina courts ruled HOA amendments banning STRs can be “unreasonable and unenforceable” if CC&Rs were originally silent and amendments exceed residential character maintenance purposes.

Due Diligence Requirements:

- Obtain complete CC&Rs for specific complex

- Review recent HOA board meeting minutes

- Request written STR confirmation from HOA

- Verify pending amendments affecting rentals

- Check rental cap status (some limit 20-25% of units)

Ready to explore investment opportunities? Schedule a consultation to discuss your specific investment goals.

Important Data Attribution Notice

Lake Norman Market-Wide vs. Davidson-Specific Performance:

The revenue and performance metrics cited throughout this guide represent Lake Norman market-wide averages unless specifically noted as Davidson-only data. Davidson Landing condos and other Davidson-area vacation rentals may perform below these market-wide averages, particularly:

- Non-waterfront units may achieve lower ADRs

- Smaller condo units typically generate less revenue than large homes

- Properties without premium amenities perform below luxury segment averages

- Location within Davidson affects proximity premiums

The $200,000-$350,000+ revenue figures specifically apply to large, luxury lakefront estates and should not be considered representative of typical Davidson condo performance.

Market Competition Analysis 2025

Supply and Demand Dynamics

Lake Norman's STR market experiences increasing competition with 358 active Airbnb listings in the Mooresville area alone. Inventory growth reflects homeowner recognition of rental potential, creating both opportunities and challenges for new investors.

Competitive Advantages for Davidson Properties:

- Proximity to Davidson College athletic events

- Annual town festivals (Town Day, Christmas in Davidson)

- Walkability to downtown Davidson attractions

- Established family-friendly reputation

Learn more about things to do in Davidson, NC that attract vacation rental guests.

Seasonal Demand Patterns

Lake Norman Market-Wide Seasonal Patterns:

Peak Season (June-July):

- ADR: $633 (market-wide average)

- Occupancy: 62% (market-wide average)

- Monthly Revenue: $10,527 (market-wide average)

Low Season (January-March):

- ADR: $553 (market-wide average)

- Occupancy: 37% (market-wide average)

- Monthly Revenue: $3,593 (market-wide average)

Davidson properties may experience different seasonal performance based on proximity to Davidson College events, which can boost occupancy during academic calendar periods.

Understanding seasonal fluctuations helps investors plan cash flow and marketing strategies effectively.

Property Management Considerations

Professional Management vs. Self-Management

Professional Management Benefits:

- 25-30% management fees typical

- Marketing across multiple platforms

- Guest communication and support

- Cleaning coordination

- Maintenance oversight

Self-Management Considerations:

- Higher time investment required

- Platform fee savings

- Direct guest relationship control

- Learning curve for optimization

For waterfront properties specifically, review our guide on Lake Norman waterfront homes in Davidson.

Marketing and Positioning Strategies

Effective Positioning Elements:

- Davidson College proximity marketing

- Lake access and water activities

- Charlotte metropolitan access

- Family-friendly community amenities

Guest Attraction Factors:

- Resort-style community amenities

- Boat slip availability

- College event attendance

- Corporate retreat bookings

Financial Planning and Financing Options

Financing Considerations for STR Investments

Traditional Financing Challenges:

- Higher down payment requirements (25-30%)

- Investment property interest rates

- Debt-to-income ratio calculations

- Lender STR restrictions

Alternative Financing Options:

- Portfolio lenders

- Hard money loans

- Cash purchases for immediate cash flow

- 1031 exchanges from other investments

Tax Implications and Strategies

Depreciation Benefits:

- Residential rental property depreciation

- Furnishing and equipment depreciation

- Improvement cost recovery

Business Expense Deductions:

- Management fees

- Cleaning and maintenance

- Marketing costs

- Travel expenses for property oversight

For broader investment context, explore coastal NC investment properties as portfolio diversification options.

Market Outlook 2025-2026

Growth Drivers

Positive Market Factors:

- Charlotte metropolitan growth

- Davidson College expansion

- Lake Norman tourism development

- Infrastructure improvements

Potential Challenges:

- Interest rate environment

- Increased competition

- Regulatory changes

- Economic uncertainty

Investment Timing Considerations

Market Entry Strategies:

- Target underperforming properties with improvement potential

- Focus on unique amenities or locations

- Consider off-season purchase timing

- Negotiate based on realistic cash flow projections

Luxury Market Segment Analysis

High-end Lake Norman properties command premium pricing and occupancy rates. Luxury lakefront estates with superior amenities and prime locations generate $200,000-$350,000+ in gross annual revenue for top-performing homes. These figures represent large, premium lakefront properties and do not reflect typical performance for Davidson Landing condos or smaller vacation rental units.

Luxury Market Characteristics (Large Lakefront Estates):

- Premium lakefront locations with private docks

- 4+ bedroom luxury homes

- High-end finishes and resort-style amenities

- Boat slip inclusions and waterfront access

- Concierge services availability

Explore our analysis of Lake Norman luxury real estate in Davidson for high-end investment opportunities.

Comparative Market Analysis

Davidson vs. Other Lake Norman Communities

| Community | Median Price | Occupancy Tax | HOA Restrictions | College Proximity |

|---|---|---|---|---|

| Davidson Landing | $533K-$560K | 8% | Variable by complex | Excellent |

| Mooresville | $400K-$500K | 8% | Varies | Moderate |

| Cornelius | $450K-$550K | 8% | Varies | Good |

| Huntersville | $425K-$525K | 8% | Varies | Moderate |

For detailed comparisons, review our guides on living in Mooresville, NC, living in Cornelius, NC, and living in Huntersville, NC.

Alternative Investment Strategies

55+ Community Investments

Davidson area offers specialized housing options for different demographics. 55+ communities near Davidson and Lake Norman provide alternative investment opportunities with different rental regulations.

Condo and Townhome Markets

For investors preferring lower-maintenance options, Lake Norman condos and townhomes in Davidson offer diverse investment possibilities with varying price points and rental potential.

Risk Management Strategies

Insurance Requirements

STR-Specific Coverage Needs:

- Liability protection for guests

- Property damage coverage

- Loss of income protection

- Commercial use endorsements

Cost Considerations:

- Annual premiums: $2,000-$3,000

- Higher deductibles typical

- Multi-property discounts available

Legal Protection Measures

Recommended Protections:

- LLC formation for liability protection

- Comprehensive guest agreements

- Property condition documentation

- Emergency contact protocols

Ready to discuss your investment strategy? Contact our team for personalized guidance.

Due Diligence Checklist

Pre-Purchase Investigation

Essential Research Items:

- HOA CC&R review for rental restrictions

- Property tax assessment verification

- Rental income potential analysis

- Competition assessment in complex

- Infrastructure and amenity condition

- Future development impact evaluation

Financial Analysis Tools

Key Calculations:

- Cap rate analysis

- Cash-on-cash return

- Total return on investment

- Break-even occupancy rate

- Sensitivity analysis for variables

Frequently Asked Questions

What is the average ROI for Lake Norman vacation rentals in Davidson?

Lake Norman vacation rentals generate market-wide median annual revenues of $56,400-$66,022, though Davidson condo performance typically varies below these averages depending on location and amenities. Top-performing luxury lakefront estates achieve 8-12% cash-on-cash returns, while median-performing Davidson condos often experience negative cash flow due to high occupancy taxes, operating expenses, and below-market performance.

Are short-term rentals legal in Davidson, NC?

Short-term rentals are legal in Davidson, NC, with no specific municipal licensing requirements. However, investors must comply with 8% Mecklenburg County occupancy tax, state sales tax, and individual HOA restrictions. Davidson Landing properties face varying rental restrictions depending on the specific complex's CC&Rs.

How much does it cost to manage a vacation rental on Lake Norman?

Professional vacation rental management on Lake Norman typically costs 25-30% of gross revenue. For a property generating $60,000 annually, management fees range from $15,000-$18,000. Additional costs include cleaning (20% of revenue), maintenance, insurance, and marketing fees totaling approximately 50-60% of gross revenue.

Conclusion: Making Informed Investment Decisions

Lake Norman vacation rental investments in the Davidson area require careful analysis beyond surface-level returns. While top-performing properties achieve attractive returns, median performers often struggle with cash flow due to high operating costs and tax burdens.

Success factors include:

- Thorough HOA restriction research

- Conservative financial projections

- Professional management consideration

- Understanding seasonal demand patterns

- Compliance with all tax obligations

For personalized investment guidance tailored to your specific situation and goals, schedule a consultation with our Lake Norman real estate investment specialists.

Additional Resources:

- Lake Norman marina guide for Davidson properties

- Rent vs buy analysis for Lake Norman Davidson properties

- Davidson NC school districts guide

- Commuting from Davidson to Charlotte

This analysis is based on 2025 market data and should not be considered personal financial advice. Consult with qualified professionals before making investment decisions.

Categories

- All Blogs (55)

- invest in coastal NC (1)

- Investing in Lake Norman (1)

- Living in Carolina Beach NC (2)

- Living in Cornelius NC (1)

- Living In Davidson NC (2)

- Living in Huntersville NC (1)

- Living in Kure Beach NC (1)

- Living in Mooresville NC (1)

- Living in Surf City NC (2)

- Living in Topsail Island NC (4)

- Living in Wriightsville Beach NC (3)

- Living on Lake Norman (30)

- Move to Carolina Beach, NC (1)

- Move to Kure Beach NC (1)

- Move to Surf City NC (1)

- Move to Topsail Island NC (1)

- Moving to Wrightsville Beach NC (1)

- Retire in Carolina Beach NC (1)

- retire in Kure Beach NC (1)

- Retire in Surf City NC (1)

- Retire in Topsail Island NC (1)

- Retire in Wrightsville Beach NC (1)

Recent Posts