Rent vs Buy Lake Norman Home: Davidson NC 2025 Financial Analysis & Decision Guide

Updated October 22, 2025

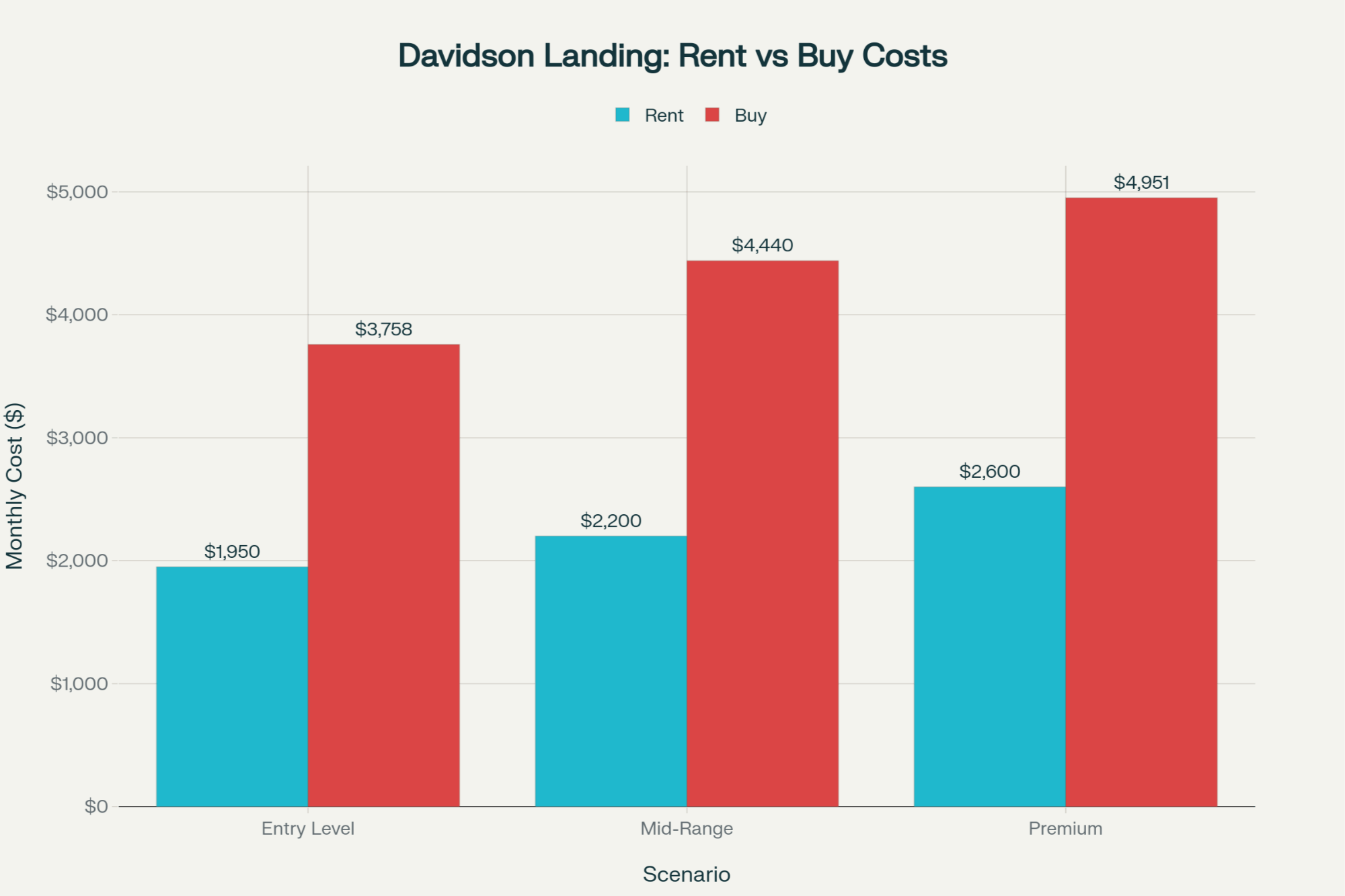

Buying a Lake Norman home in Davidson, NC costs significantly more monthly than renting but becomes financially advantageous after 7 years. Current ownership costs range from $3,758 to $4,951 monthly compared to rental rates of $1,950 to $2,600, with long-term equity building and tax benefits making purchasing attractive for buyers planning extended stays.

Lake Norman Davidson Housing Market: Complete Rent vs Buy Financial Breakdown 2025

The Lake Norman real estate market in Davidson presents buyers and renters with distinct financial considerations. With Davidson's unique position straddling two counties and direct lake access, property decisions require careful analysis of both immediate costs and long-term financial implications.

Current Davidson Lake Norman Market Overview

Davidson Landing leads the luxury waterfront market with condos and townhomes across twelve distinct complexes. Current market conditions show median sales prices of approximately $533,000 in 2025, representing 6.6% year-over-year appreciation based on local MLS data.

Davidson Landing Complex Price Ranges

- Tennis Villas: $380,000 - $500,000 (HOA: $161/month)

- Edgewater: $429,000 - $589,000 (HOA: $200/month)

- Southharbortowne: $375,000 - $639,000 (HOA: $386/month)

- Stone Bluff: $470,000 - $760,000 (HOA: $213/month)

- Portside: $520,000 - $750,000 (HOA: $314/month)

The broader Davidson market has experienced substantial growth, with approximately 75–80% price appreciation since 2020 according to regional MLS data, and 31.7% of listings now exceeding $1 million. This growth trajectory mirrors trends seen in other desirable Lake Norman communities.

Lake Norman Davidson Rental Market Analysis

Rental rates in Davidson command premium pricing due to college town appeal and direct lake access. Current market data reveals:

Davidson Landing Rental Rates

- 2-bedroom condos: $1,655 - $2,395/month

- 3-bedroom condos: $2,350 - $2,900/month

- Average rent per square foot: $2.11

The broader Lake Norman rental market averages $1,657/month with 1,259 square feet, while Davidson-specific rentals command higher rates. This premium reflects the area's proximity to Davidson College and Charlotte's business district.

Comprehensive Financial Analysis: Renting vs Buying Davidson Homes

Monthly Cost Breakdown for Mid-Range Scenario ($575,000 Purchase)

Monthly Homeownership Costs

- Principal & Interest: $2,847 (6.3% mortgage rate)

- Property Taxes: $354 (Mecklenburg County: 0.739%)

- Home Insurance: $270 ($3,237 annual average)

- HOA Fees: $250 (complex dependent)

- Maintenance/Repairs: $719 (1.5% of home value annually for waterfront)

- Total Monthly Ownership: $4,440

Comparable Monthly Rent: $2,200

Monthly Premium for Buying: $2,240

Break-Even Analysis: When Does Buying Make Financial Sense?

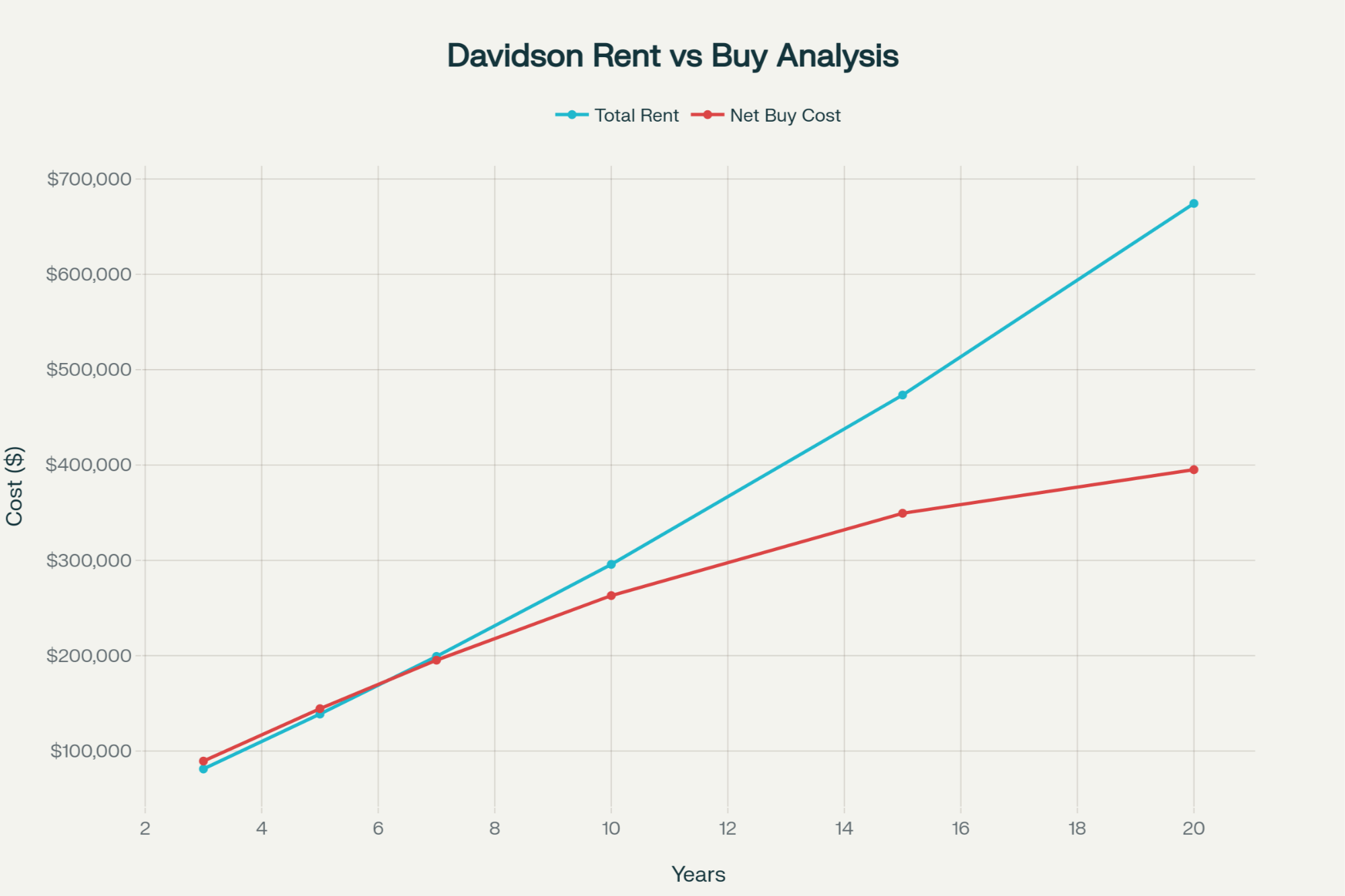

The financial crossover point occurs at 7 years of ownership, assuming static rent growth. This timeline could shift earlier if rental inflation exceeds property appreciation rates.

Short-term outlook (3–5 years)

- Renting saves $5,657–$8,245

- Lower upfront costs and maintenance responsibilities

- Greater flexibility for job changes or lifestyle adjustments

Long-term outlook (10+ years)

- Buying saves $32,727–$279,276

- Significant equity accumulation

- Stable housing costs with fixed mortgage payments

20-year total costs

- Rent: $674,379

- Net buying cost: $395,103

- Total savings from buying: $279,276

Note: This analysis assumes current rent inflation trends. Accelerated rental cost increases could favor buying earlier than the 7-year break-even point.

Tax Benefits and True Cost Analysis

Federal tax deductions significantly impact the real cost of homeownership for Davidson Lake Norman properties:

Annual Tax Deductions (25% bracket)

- Mortgage Interest: ~$29,039

- Property Taxes: $4,248

- Total Tax Savings: ~$8,322 annually

Adjusted Monthly Ownership Cost: $3,747 (after tax benefits)

Adjusted Premium Over Rent: $1,547/month

These tax advantages become particularly valuable for higher-income professionals working in Charlotte who frequently purchase Lake Norman luxury properties.

Property Tax Considerations: Mecklenburg vs Iredell County

Davidson's unique location creates distinct tax implications depending on property location:

- Mecklenburg County Side: 0.739% combined rate

- Iredell County Side: 0.766% combined rate

For a $575,000 home, this difference equals approximately $135 annually, making Mecklenburg County properties slightly more attractive from a tax perspective.

Waterfront Property Investment Considerations

Additional Costs for Lake Norman Properties

- Dock slip rental: $125–150/month (optional)

- Higher insurance: 10–15% premium for waterfront location

- Enhanced maintenance: ~50% higher costs due to moisture and erosion

- Specialized inspections: Lake Norman home inspection requirements

Lifestyle Benefits

- Direct Lake Norman access (32,000 acres)

- Resort-style amenities: pools, tennis, walking trails

- Proximity to Davidson College and Charlotte (30 minutes)

- Top-rated school districts

- Strong rental income potential for investment properties

Ready to explore your Lake Norman options? Schedule a consultation with our Davidson specialists.

Decision Matrix: Should You Rent or Buy in Davidson?

Choose Renting If You:

- Plan to stay less than 7 years

- Prefer flexibility and minimal maintenance responsibility

- Cannot comfortably afford $95,000–$130,000 down payment

- Value lower monthly cash outlay ($1,200–2,300 less monthly)

- Want to avoid repair risks and property management

- Are exploring different Lake Norman communities

Choose Buying If You:

- Plan 7+ year residency

- Desire equity building and long-term wealth creation

- Can afford higher monthly payments for lifestyle benefits

- Want control over property modifications and improvements

- Seek tax advantages from mortgage interest deductions

- Value stable housing costs with predictable payments

2025 Market Recommendations

For Potential Buyers

- Mecklenburg County properties offer slight tax advantages

- Consider entry-level complexes (Tennis Villas, Edgewater) for better value

- Factor in additional $200–400/month for dock slips and enhanced amenities

- Plan for 7+ year ownership to achieve financial break-even

- Research Davidson Landing buyer requirements thoroughly

For Potential Renters

- Excellent short-term option with significant monthly savings

- Consider 2-bedroom units for best value at $1,775–$2,100/month

- Budget for potential 2.5% annual rent increases

- Evaluate total lifestyle costs including separate boat storage if desired

- Explore different Lake Norman rental markets for comparison

Lake Norman Investment Property Potential

Davidson's rental market strength makes it attractive for investment purposes. Key metrics based on current market analysis include:

- Average rental yields: 5–7% gross returns (calculated using current rental rates and purchase prices)

- Strong demand from Davidson College staff and Charlotte commuters

- Seasonal rental potential during peak lake season

- Limited waterfront inventory supporting appreciation

For investors considering Lake Norman investment properties, Davidson offers solid fundamentals with consistent rental demand.

Market Outlook and Future Predictions

- Market Drivers: Charlotte's continued economic growth, limited developable waterfront land, Davidson College's prestige, and enhanced remote work flexibility increasing suburban demand.

- 2025–2026 Projections: Continued modest appreciation (3–5% annually), stable rental demand with potential rate increases, and limited new construction maintaining scarcity value.

The analysis supports long-term purchasing for residents planning extended stays, while renting remains optimal for shorter-term arrangements.

Financing Considerations for Davidson Lake Norman Properties

Mortgage Market Conditions

- Rate lock strategies for purchase contracts

- ARM products for shorter ownership timelines

- Jumbo loan requirements for higher-priced properties

- Down payment assistance programs for qualified buyers

Insurance Requirements

- Standard homeowners insurance: $270/month average

- Flood insurance: Often required for waterfront locations

- Umbrella policies: Recommended for liability protection

- Wind/hail coverage: Essential for lakefront properties

Connect with our team for personalized financing guidance: Schedule your consultation.

Practical Next Steps

For Serious Buyers

Financial Preparation

- Secure mortgage pre-approval

- Accumulate 20% down payment ($95,000–$130,000)

- Budget for closing costs (2–3% of purchase price)

- Plan for immediate HOA and utility setup costs

Property Research

- Compare Lake Norman waterfront communities

- Evaluate specific complex amenities and restrictions

- Research property tax implications by county

- Understand dock slip availability and costs

For Potential Renters

Market Research

- Compare rental rates across different complexes

- Understand lease terms and renewal policies

- Evaluate included amenities and utilities

- Consider seasonal rate variations

Application Preparation

- Gather employment and income documentation

- Prepare rental history references

- Budget for security deposits and first month's rent

- Understand HOA restrictions for renters

Additional Lake Norman Resources

- Living in Mooresville, NC

- Huntersville Community Overview

- Cornelius Neighborhood Guide

- Lake Norman Annual Events

Those interested in retirement planning should consider retiring on Lake Norman for comprehensive lifestyle and financial planning insights.

FAQ: Davidson Lake Norman Rent vs Buy Decisions

How long should I plan to stay to make buying worthwhile in Davidson?

The break-even point for purchasing versus renting in Davidson occurs at 7 years, assuming current rent inflation trends. Buyers planning shorter stays should consider renting due to transaction costs and limited equity accumulation in early ownership years. This timeline could shift earlier if rental costs increase faster than property appreciation.

What are the hidden costs of owning waterfront property on Lake Norman?

Beyond standard homeownership costs, waterfront properties incur additional expenses including enhanced maintenance (50% higher costs), specialized insurance premiums (10–15% increase), optional dock slip rentals ($125–150/month), and potential flood insurance requirements. These costs should be factored into the 7-year break-even analysis.

Should I choose Mecklenburg or Iredell County side of Davidson for better value?

Mecklenburg County properties offer slight tax advantages with a 0.739% combined rate versus Iredell County's 0.766% rate. For a $575,000 home, this saves approximately $135 annually, though property-specific factors often outweigh this difference. Consider Davidson NC property tax implications for detailed analysis.

The Davidson Lake Norman market offers compelling opportunities for both renters and buyers, with the optimal choice depending on individual timelines, financial capacity, and lifestyle priorities. Long-term residents benefit significantly from homeownership, while shorter-term arrangements favor rental flexibility.

Data sources: Local MLS records, Mecklenburg County Tax Assessor, regional rental market surveys, and mortgage rate tracking services. Market conditions and rates subject to change.

For personalized guidance on your Davidson Lake Norman housing decision, contact our local specialists who understand the nuances of this unique waterfront market.

Categories

- All Blogs (51)

- invest in coastal NC (1)

- Investing in Lake Norman (1)

- Living in Carolina Beach NC (2)

- Living in Cornelius NC (1)

- Living In Davidson NC (2)

- Living in Huntersville NC (1)

- Living in Kure Beach NC (1)

- Living in Mooresville NC (1)

- Living in Surf City NC (2)

- Living in Topsail Island NC (4)

- Living in Wriightsville Beach NC (3)

- Living on Lake Norman (26)

- Move to Carolina Beach, NC (1)

- Move to Kure Beach NC (1)

- Move to Surf City NC (1)

- Move to Topsail Island NC (1)

- Moving to Wrightsville Beach NC (1)

- Retire in Carolina Beach NC (1)

- retire in Kure Beach NC (1)

- Retire in Surf City NC (1)

- Retire in Topsail Island NC (1)

- Retire in Wrightsville Beach NC (1)

Recent Posts